DISTRICT INFORMATION

DEPARTMENTS

ACADEMICS

ATHLETICS

BUSINESS SERVICES

FOOD SERVICES

STUDENTS/PARENTS

2024 Bond Information

BOND VOTE MAY 7TH, 2024

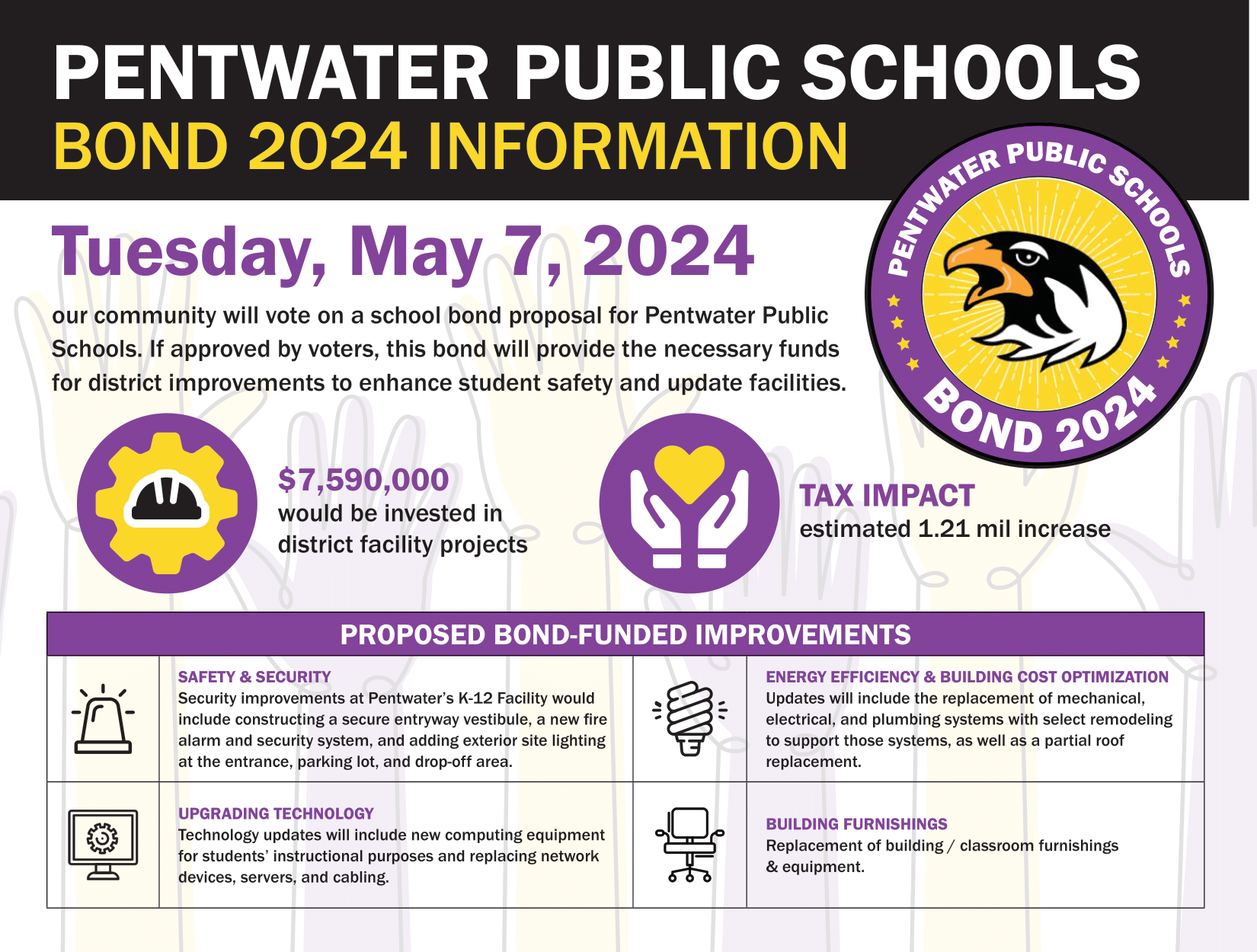

On May 7th, 2024, our community will vote on a school bond proposal for Pentwater Public Schools. If approved by voters, this bond will provide the necessary funds for district improvements to enhance student safety and update facilities.

When is the election?

Tuesday, May 7, 2024. The polls will be open from 7 a.m. until 8 p.m.

What is a bond?

A bond is a state-approved funding process for an identified list of projects. When voters approve a bond proposal, the school district sells bonds in the authorized amount and uses the bond sale proceeds to pay for the bond proposal projects. The Pentwater Public Schools’ bond proposal length is 17 years.

What is on the ballot?

A $7,590,000 bond proposal is on the ballot to enhance safety and update Pentwater Public Schools’ facilities. Voters residing within the boundaries of Pentwater Public Schools will vote on the bond proposal to fund updates, renovation, and construction in four general areas:

• Improving student safety and school security

• Upgrading instructional technology and technology infrastructure

• Upgrading building infrastructure to improve energy efficiency and reduce operating costs

• Upgrading building furnishings

All bond proposal projects have been reviewed and approved by the Michigan Department of Treasury.

What will I pay if the Bond passes?

If the Bond passes, it is estimated that this proposal will result in a 1.21 mil increase ($1.21 on each $1,000 of taxable valuation) over the current rate. For the Pentwater homeowner with a $100,000 market value home ($50,000 taxable value), the estimated tax bill impact in YEAR 1 for the proposed bonds will cost approximately $60.50 or $5.04 monthly.

How will the bond proposal improve school safety?

Keeping Pentwater Public Schools’ students and staff safe is a priority of the Pentwater Board of Education. Through the bond proposal, security improvements at Pentwater’s K-12 Facility will include constructing a secure entryway vestibule, a new fire alarm system, a security system, and adding exterior site lighting at the entrance, parking lot, and drop-off area.

What technology updates are included with the bond proposal?

Updates will include new computing equipment for students’ instructional purposes and replacing network devices, servers, and cabling. What building infrastructure & energy-efficiency updates are included with the bond proposal? Updates will include the replacement of mechanical, electrical, and plumbing systems with select remodeling to support those systems, as well as a partial roof replacement.

How were the bond projects developed?

The bond proposal began with an in-depth Pentwater Public Schools’ K-12 facility assessment. The assessment was conducted in December 2023 by the District’s construction manager, architect, and engineers working with school administration members.

Why is the bond proposal necessary?

The bond proposal is necessary because, like your home, mechanical systems, roofs, flooring, technology, etc., wear out and must be replaced. Enhancing student and staff safety while improving the educational environment will keep Pentwater Public Schools competitive with surrounding school districts and meet the learning needs of our students now and in the future.

How long will it take to complete all bond proposal projects?

The District’s architect will begin developing construction drawings following voter approval, and then a construction schedule will be developed. It is estimated that all construction projects will be completed by 2027.

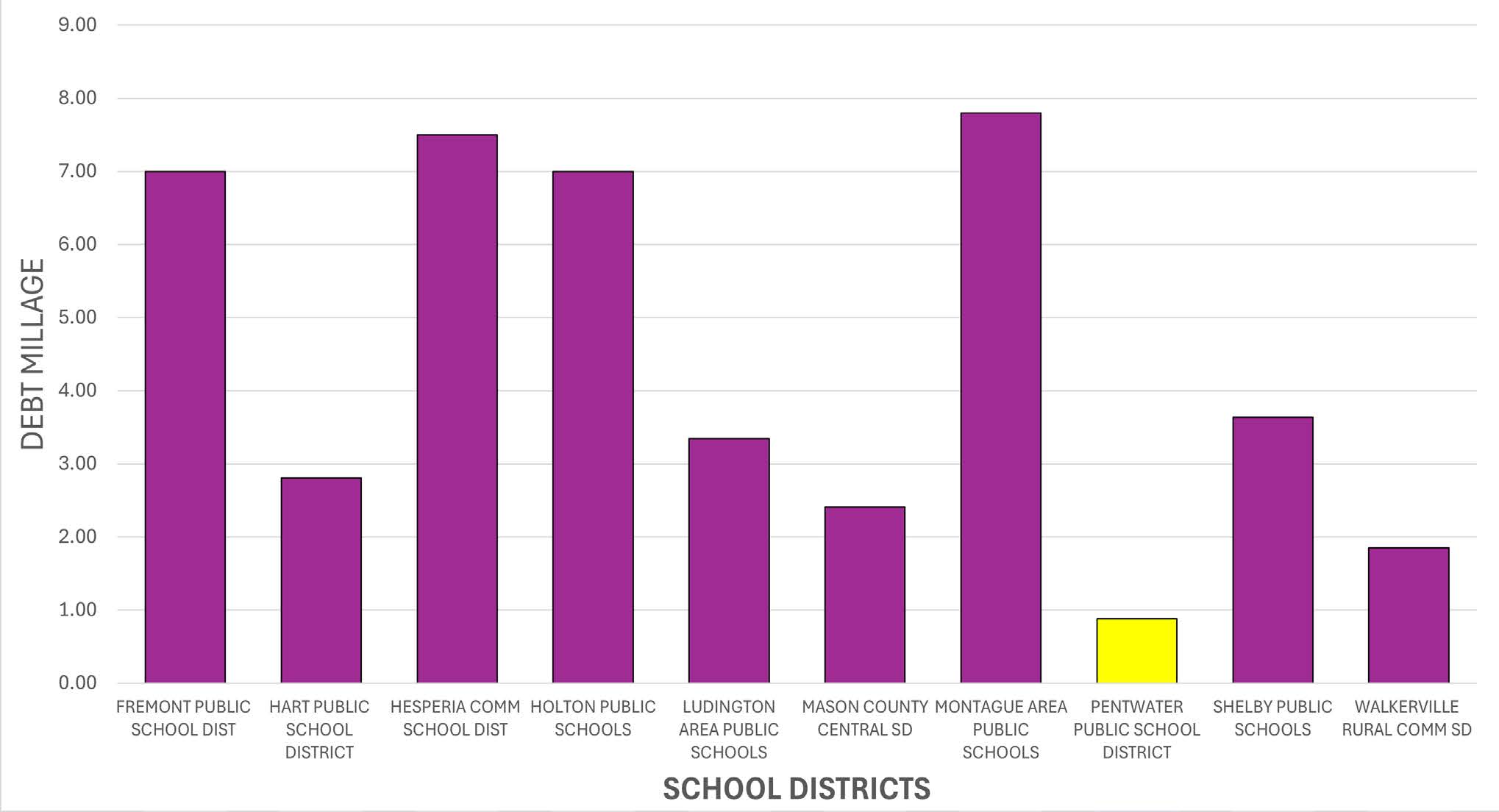

How does Pentwater Public Schools’ debt millage compare to surrounding districts?

Does the District have any current bonds?

The District currently has a bond for .82 mil (issued in 2005) which will be paid off in 2028.

How much has the District spent on capital improvement costs since 2022?

Approximately $200,000.

What is the difference between a bond and a sinking fund?

A bond is a State-approved funding process that specifies a set scope of projects. When voters approve a bond, the money specified in the bond proposal is borrowed and the school district makes payments over a period of years, much like a homeowner pays a mortgage. The Pentwater Public Schools’ proposed bond length is 17 years. A sinking fund is a financing initiative that gives a school district flexibility in meeting its individual needs. The project list is not specified in detail and a school district can add or remove items as needs arise. Unlike a bond, sinking funds can be used for repairs and maintenance and are more like a savings account or a rainy-day fund. They cannot be used for technology or transportation related items. School districts can only levy up to 3 mils for a maximum of 10 years.* If a sinking fund is passed, the millage is assessed annually. Both bonds and sinking funds are audited separately from the general budget to account for every dollar spent by the District.

*Because of our immediate facility needs, there would not be a sufficient amount of funding generated in the required timeline to complete the necessary project items in this bond proposal.

Can bond proposal funds be used for employee salaries, repairs, maintenance, or operating expenses?

No. Bond proposal funds cannot be used for employee salaries. They also cannot be used for repair, maintenance, or other operating expenses. Bond proposal funds can only be used for the purposes specified in the ballot language, and, as required by state law, they must be independently audited.

What oversights would hold the District accountable?

If approved by voters, the District’s Architect/Engineer would design the proposed projects and prepare construction documents and specifications for the projects. Once the projects are designed, the District’s Construction Manager will assemble bid packages and publicly advertise to solicit competitive bids for all work. This is required by law, as outlined in the Revised School Code. This process ensures that the District selects the lowest responsive and responsible bidder. All qualified contractors can attend a pre-bid meeting to obtain additional information and project clarification. All qualified contractors will be able to participate in the competitive bid process.

What’s the exact wording that will appear on the ballot?

PENTWATER PUBLIC SCHOOLS

BOND PROPOSAL

Shall Pentwater Public Schools, Oceana and Mason Counties, Michigan, borrow the sum of not to

exceed Seven Million Five Hundred Ninety Thousand Dollars ($7,590,000) and issue its general

obligation unlimited tax bonds therefor, for the purpose of: erecting an addition to, remodeling, including security

improvements to, furnishing and refurnishing, and equipping and reequipping a school building; acquiring and installing instructional

technology and instructional technology equipment for a school building; and developing and improving a site?

The following is for informational purposes only:

The estimated millage that will be levied for the proposed bonds in 2024 is 1.21 mills ($1.21 on

each $1,000 of taxable valuation). The maximum number of years the bonds may be outstanding,

exclusive of any refunding, is seventeen (17) years. The estimated simple average annual millage

anticipated to be required to retire this bond debt is 1.60 mills ($1.60 on each $1,000 of taxable valuation).

The school district does not expect to borrow from the State to pay debt service on the bonds. The

total amount of qualified bonds currently outstanding is $0. The total amount of qualified loans

currently outstanding is $0. The estimated computed millage rate may change based on changes in

certain circumstances.

(Pursuant to State law, expenditure of bond proceeds must be audited and the proceeds cannot be

used for repair or maintenance costs, teacher, administrator or employee salaries, or other

operating expenses.)

In the ballot language, it states that the estimated millage that will be levied in 2024 to pay the proposed bonds in the first year is 1.21 mills, what does this mean?

This means that the allocated bond millage for this proposal to be levied in the first year (2024) is 1.21 mills. (1.21 mills new bonds + 0.82 mills existing bonds = 2.03 total estimated 2024 millage rate).

The ballot language states that the estimated simple average annual millage that will be required to retire each bond series is 1.60 mills annually, what does this mean?

This means that over the entire life of the bond proposal (1 bond series), that the average annual bond millage rate is estimated to be 1.60 mills.

How will residents be informed about the bond proposal?

School District officials are sharing information about the bond proposal through direct mailings, social media, the school district website, community and staff presentations, and the news media.

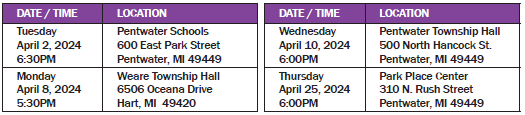

THE DISTRICT HAS COMMUNITY INFORMATION MEETINGS SCHEDULED FOR:

To view the complete list of bond projects and learn more about the bond proposal, visit Application for Preliminary Qualification of Bonds or BakerTilly Bond Proposal Summary and FAQ's.

Questions or feedback regarding the Bond Proposal can be directed to: Superintendent Scott Karapatian / skaraptian@pentwater.k12.mi.us

Where can I get more information about voting (such as how to register, where to vote, and absentee

voting)?

Go to the Michigan Voter Information website (www.michigan.gov/vote) or call your local Clerk’s Office.

When can registered voters obtain an absentee ballot?

Absentee ballots are required by Michigan law to be available to registered voters on March 23, 2024, through Election Day.

Are there property tax exemptions for anyone of any kind?

One item a community member could research is the Michigan Homestead Property Tax Credit. The Michigan Homestead Property Tax Credit is a method through which some taxpayers can receive a credit for an amount of their property tax that exceeds a certain percentage of their household income. This program establishes categories under which homeowners or renters are eligible for a Homestead Property Tax Credit. We recommend that community members consult their tax provider to determine if they qualify for this tax credit.

Questions?

Scott Karaptian, Ph.D., Superintendent/Principal

Pentwater Public Schools

(231) 869-4100

skaraptian@pentwater.k12.mi.us